FOR IMMEDIATE RELEASE

Tuesday, December 5, 2023

Contact:

Rocky Moretti (202) 262-0714 (cell)

Carolyn Bonifas Kelly (703) 801-9212 (cell)

PENNSYLVANIA VALUE OF FREIGHT SHIPPED, RATE OF LARGE TRUCK TRAVEL AND PROJECTED INCREASES IN FREIGHT SHIPMENT BY 2050 AMONG LARGEST IN NATION.

U.S. freight demand surges amid significant congestion, e-commerce demands, increased fatal truck crashes, inadequate investment and record-setting logistics costs.

Click here for the full report, appendix and infographics.

Washington, D.C. – As the U.S. rebounds from the pandemic, the reliability, capacity, sustainability and safety of the freight transportation system will be critical factors in the nation’s ability to provide a supply chain that will meet the growing need for timely and safe movement of goods. This is according to a new report released today by TRIP, a national transportation research nonprofit. The movement of freight is being transformed by advances in vehicle autonomy, manufacturing, warehousing and supply chain automation, increasing e-commerce, and the growing logistic networks being developed to accommodate consumer demand for faster delivery.

TRIP’s report, America’s Rolling Warehouses: Opportunities and Challenges with the Nation’s Freight Delivery System, examines current and projected levels of freight movement in the U.S., large truck safety, and trends impacting freight movement. Freight delivery is expected to increase rapidly due to economic growth, increasing demand, changing business and retail models, and a significantly increased reliance on e-commerce. TRIP’s report concludes with a series of recommendations to improve the nation’s freight transportation system.

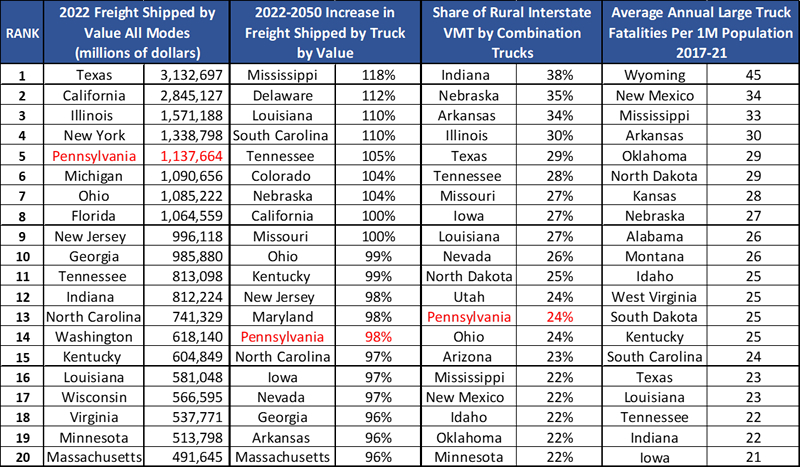

In 2022 Pennsylvania’s freight system moved 897 million tons of freight, valued at $1.1 trillion – the fifth largest value of freight moved of all states. The TRIP report also found that 14 percent of travel on Pennsylvania’s Interstate highways and 24 percent of travel on its rural Interstate highways is by combination trucks – the 13th highest share in the nation. From 2022 to 2050, freight moved annually in Pennsylvania by trucks is expected to increase 57 percent by weight and 98 percent by value (inflation-adjusted dollars), the 14th largest projected increase in the nation. From 2017 to 2021, an average of 148 people were killed annually in Pennsylvania in collisions involving a large truck, approximately 11 annual fatalities per 100 million population.

The report’s appendix includes data for all 50 states in the following categories: amount of freight moved by weight and value (overall and by truck), projected increase in weight and value of freight shipped from 2022-2050, share of Interstate travel by combination trucks, and the number of traffic fatalities involving large trucks.

While the amount and value of goods being shipped have risen to unprecedented levels, traffic congestion is increasing the cost of moving freight and reducing the economic competitiveness and efficiency of businesses that require reliable, affordable freight transportation. Traffic congestion resulted in $94.6 billion in additional operational costs to the trucking industry in 2022 as a result of commercial trucks being stuck in traffic for 1.3 billion hours. U.S. business logistics costs reached $2.3 trillion in 2022, representing 9.1 percent of U.S. GDP – the highest share ever.

“Within a day’s drive, you can reach the furthest point in Maine, New York City, and 40 percent of the country’s population from Pennsylvania,” said Keystone Transportation Funding Coalition Founder George Wolff. “We are also blessed with three international ports that are key in exporting agricultural products, as one of the largest agriculture-producing states in the northeast. Our strategic location is largely why we’ve seen major growth in distribution warehouses and freight movement across the state. This not only generates more wear and tear on rural interstates and local roadways but also impacts multimodal systems across the board, including more traffic for public transit and shared riders, increased costs for farmers moving food from farm to market, increased air and seaport movement, and impacts on the environment. The continued growth of e-commerce and supply chains that support quick deliveries will cause these impacts to compound. We need to think comprehensively and take a good look at how our system is funded and structured to support the inevitable continued growth of freight movement.”

According to the TRIP report, from 2017 to 2021, the number of fatalities in large-truck involved crashes in the U.S. increased 18 percent, from 4,906 to 5,788. Approximately five-out-of-six people killed in crashes involving a large truck were occupants of the other vehicle involved in the crash or pedestrians or bicyclists. While large trucks account for five percent of all registered vehicles and ten percent of all vehicle miles of travel annually, 13 percent of traffic fatalities occur in traffic crashes in which a large truck was involved. The most frequent event prior to fatal crashes between large trucks and another vehicle is the entering or encroaching into a large truck’s lane by the other vehicle.

“The TRIP report describes in stark detail the current and future challenges that the trucking industry must overcome to meet the nation’s supply chain needs,” said Bill Sullivan, chief public affairs and advocacy officer for the American Trucking Associations. “Increased public investment in highway capacity expansion, truck parking facilities and other critical highway infrastructure is essential to improving highway safety and freight efficiency. The report’s recommendations provide a great roadmap for lawmakers to address the highway system’s deficiencies.”

Multiple technological advances will transform how freight is delivered in the future. These include the growing use of artificial intelligence, which is driving manufacturing and increasing the efficiency of logistics; increased automation in warehousing and supply chains; expanded growth and reliance on e-commerce; changing global logistics patterns; advances in vehicle autonomy; and, the transition to environmentally friendlier fuels to reduce transportation greenhouse gas emissions. A lack of adequate parking for large trucks and a shortage of available truck drivers, particularly for long-haul trips, challenge the safety and efficiency of the nation’s freight system. In the last decade, U.S. retail e-commerce sales increased nearly four and a half times, from $64 billion in the second quarter of 2013 to $278 billion in the second quarter of 2023. The COVID-19 pandemic rapidly accelerated the growth in retail e-commerce, with U.S. e-commerce sales increasing from $160 billion in the first quarter of 2020 to $278 billion in the second quarter of 2023 – a 73 percent increase.

“U.S. manufacturers have proven remarkable resilience following persistent supply chain disruptions that have impacted our operations, led to longer lead times on many things like components, and a left us with a tight labor market,” said Todd Stucke, incoming president of Kubota Tractor Corporation and executive officer of Kubota Corporation, as well as chair of the Association of Equipment Manufacturers. “This unpredictability means that we must be laser focused on maintaining the health, safety, and efficiency of our freight transportation network. This is vital to making sure U.S. manufacturers can continue to adapt and meet the demand for our world-class products domestically and remain competitive globally.”

“As Congress prepares to consider major legislation reauthorizing our national highway system, TRIP’s report highlights the vital role the nation’s freight transportation plays in the lives of Americans and offers a set of practical and effective recommendations to generate the investment, innovation and collaboration to ensure the continued viability of our nation’s freight network and supply chain,” said John Drake, vice president for transportation, infrastructure and supply chain policy at the U.S. Chamber of Commerce.”

TRIP’s report concludes with a series of recommendations to improve freight transportation by increasing capacity on the nation’s freight transportation system, particularly at major bottlenecks; improving the reliability and condition of intermodal connectors between major highways and rail, ports and waterways; continued development of vehicle autonomy and the further automation of warehousing; improving roadway safety and providing additional truck parking spaces to ensure adequate and timely rest for drivers; providing funding for freight transportation improvements that is substantial, continuing, multimodal, reliable, and, in most cases, specifically dedicated to freight transportation projects; and, providing a permanent, adequate and reliable funding fix to the federal Highway Trust Fund as a critical step towards funding a 21st Century freight transportation system.

“As consumers demand faster deliveries and a more responsive supply chain, the nation’s freight transportation network is facing unprecedented roadblocks in the form of increasing congestion and a lack of transportation funding to improve the nation’s transportation system,” said David Kearby, executive director of TRIP. “A long-term, sustainable source of revenue that supports needed transportation investment will be crucial to improving the efficiency and safety of America’s freight transportation system.”